In Martium, ut pars sustentationis fabricae productorum bisphenoli A infra fluentis, et pars inopiae initii terminalis, effecit ut pressio aucta sit copiae et postulationis in foro phenoli in brevi termino, sed nuper pretia futura olei crudi alta currunt, pretia phenoli materiae rudis, benzeni puri et propyleni, ad summum finem impellentes, pretia transmissionis deorsum sumptus, ludus copiae et postulationis, emptio et venditio laminae serrae, interruptio ascendente adhuc auxilio eget.

Mense Martio, cum unitas phenol ketonis Yanshan Petrochemical East denuo incepit, unitas phenol ketonis Zhejiang Petrochemical 2 productionem intendit, et reliquae unitatis phenol ketonis domesticae eo mense nullum consilium est ad sustentationem sistendam. Summa onus initiale unitatis phenol ketonis domesticae in alto gradu mansit, et copia mercatus phenoli domestica significanter augeri exspectatur comparata cum mense proximo. Attamen, duae series unitatum bisphenol A sub Levoy Chemical tempus sustentationis ingressi sunt, unitates phenol ketonis ascendentes sustentantes in praesenti non designatae sunt. Praeterquam quod unitas bisphenol A a Zhejiang Petrochemical a die 3 Martii sustentationem sistet, tempus resumptionis adhuc determinandum est. Cum tempus resumptionis descendentes propter Annum Novum Sinense tardum sit, nuntiatum est partem regionis septentrionalis tempus resumptionis stationis descendentes ad medium Martium prope dilatum esse.

Mercatus phenoli, cum pressiones in copia et demanda brevi tempore amplificatae essent, mercatus phenoli initio Martii, debili impetu deorsum in fine Februarii, continuavit, et atmosphaera pessima industriae paulatim crassa facta est. Sed ob momentum condicionis internationalis, pretia futura olei crudi ad summum gradum deinceps perruperunt, mercatum phenoli ad summum gradum impellentes. Pretia benzeni puri et propyleni resiluerunt, et mercatus phenoli, post levem cursum sursum, cadere destitisse videbatur.

Ex recentioribus mutationibus datorum in foro phenoli, sumptus deorsum lentus est, quo propius ad finem producti ascendit relative parvus. Ex una parte, apparet fundamenta copiae et postulationis productorum inferioris pretii adhuc emendanda esse, et ex altera parte, ostendit emptores inferiores exspectare et videre animum de sustentatione crescentium sumptuum.

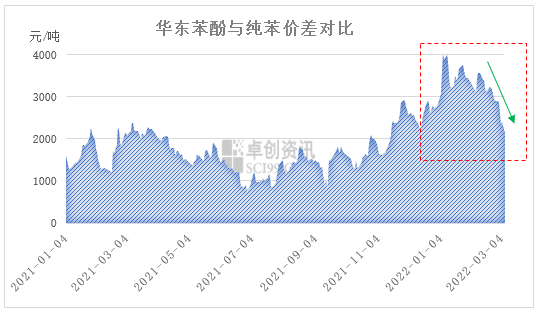

In praesenti, distributio phenoli et benzeni puri Sinarum orientalium celeriter decrescit; usque ad diem septimum mensis Martii, mercatus phenoli Sinarum orientalium clausus est inter 10900 et 11000 yuan/tonnam, benzenum purum autem inter 8750 et 8850 yuan/tonnam; differentia inter mercatum et mercatum ad 2150 yuan/tonnam rediit. Brevi tempore, pretia futura olei crudi a pretiis benzeni puri aucta vel moram in cursu maximo aucta sunt, sed mercatus phenoli relative tardus est; differentia inter mercatum et mercatum expectatur ut adhuc angustior fiat, et effectus subsidii sumptuum serotini in mercatum phenoli paulatim augebitur.

In praesenti, pretia futura olei crudi in Europa et Civitatibus Foederatis ad summos ab anno 2008 ascenderunt, pretia futura olei crudi Brent intra diem fere $140 per dolium adsunt, pretiis olei crudi crescentibus, pressione sumptuum in regionibus raffinationis inferioribus aucta est, cum dispersio phenoli et benzeni puri paulatim angustata sit, impulsus ex parte sumptuum in mercatum phenoli momentum augebit, et pretia phenoli ad altiorem gradum ostendent. Sed ad fundamenta copiae et postulationis revertentes, pressio copiae et postulationis phenoli brevis temporis adhuc magna est, praesertim in mercato septentrionali, cum recens fluxus mercium meridionalium ex una parte rhythmum augmenti pretiorum mercatus inhibeat, ex altera parte etiam pressionem inventarii mercatus septentrionalis reflectat. Ludus sumptuum et copiae et postulationis brevis temporis, emptio et venditio serrarum laminarum, interruptio crescens adhuc auxilio eget.

Tempus publicationis: IX Martii, MMXXII