TheacrylonitrilumIndustria cyclum liberationis capacitatis anno 2022 induxit, cum capacitate plus quam 10% inter annos crescente et pressione copiae augente. Simul videmus partem postulationis non tam bonam esse quam esse deberet propter pestilentiam, et industriam a declinatione dominari, cum punctis lucidis difficulter inveniendis.

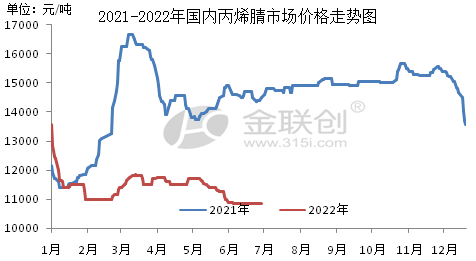

Fons datorum: Goldlink

Mercatus domesticus acrylonitrili in prima parte anni 2022 primum declivem ostendit, deinde latam oscillationem praevalens. Exemplo mercatus Sinarum Orientalium sumpto, pretium medium in prima parte anni 2022 erat 11 455 RMB/tonna, 21.29% decrescens comparatione anni prioris, cum maximo pretio 13 100 RMB/tonna, mense Ianuario, et minimo 10 800 RMB/tonna, mense Iunio.

Factores praecipui qui mercatum afficiunt sunt.

I. Incrementum copiae. Annus 2022 adhuc annus est expansionis acrylonitrili domestici concentratae, duabus seriebus officinarum acrylonitrili in operationem inductis cum capacitate totali 390 000 tonnarum/anno, inter quas Lihua Yi 260 000 tonnarum/anno et Tianchen Qixiang 130 000 tonnarum/anno. Quamquam volumen exportationis 12.1% inter Ianuarium et Maium inter annos crevit, copia et demanda tamen laxe evolvere solebant.

Secundo, recursus epidemiae pressionem auctam in copias officinarum effecit. Ab initio anni 2022, semper in statu abundantiae fuit; post impetum epidemiae, quae fine primi trimestri coepit, accumulationem copiarum societatum et societatum socialium acceleravit; logistica in Sinis orientalibus et Shandong fere cessavit, et magna area reductionis et clausurae subsequentium facta est. Post debilitationem postulationis, pressio copiarum officinarum acrylonitrili aucta est, et politica promotionis pretii minuere perrexit.

Tertio, incrementum postulationis industriae inferioris limitatum est. Novae officinae LG Huizhou, quae 150 000 tonnas per annum producuntur, in prima parte anni 2022 additae sunt ad ABS, tantum 37 500 tonnas per annum materiae primae acrylonitrili utentes. Itaque incrementum capacitatis inferioris minor est quam incrementum materiae primae. Apertura media officinarum acrylonitrili in prima parte anni prope 80% est, quod ostendit pressionem venditionum officinarum subesse.

In secunda parte anni 2022, mercatus acrylonitrili Sinensis oscillationem suam humilem continuabit, et spatium adaptationis generale relative limitatum erit. Praeterea, nova capacitas productionis acrylonitrili significanter aucta est in secunda parte anni, et quantitas mercium oblatarum fortasse perget crescere. Attamen, solum ABS novas machinas in operationem habere expectatur, postulatio generalis limitata est, et propter discrepantiam inter copiam et demandam, contradictiones inter copiam et demandam acrylonitrili crescere pergent, et cum apertura officinae etiam difficilis erit augere, societates maioris capacitatis mensuras negativas empturi sunt. Cum acrylonitrilum plerumque sub linea pretii sit, tamen necesse est attendere ad inclinationem materiae rudis propyleni. Pretia ex officina (pretia mercatus) in regiones principales inter 10 000 et 12 000 RMB/mt futura esse exspectantur, culmine probabiliter mense Augusto.

In foro acrylonitrili Sinensi in secunda parte anni 2022, propylenum, materia prima, praecipuus factor fluctuationum pretiorum est. Cum magna expansio capacitatis productionis in secunda parte anni iam praedicta sit, difficile est occasionem significantem recuperationis pretii in secunda parte habere. Ergo, pretium materiae primae propyleni factor clavis erit ad pretium acrylonitrili determinandum. Si propylenum prope 8,000 RMB/mt manet, difficile erit acrylonitrilo pergere cadere. Attamen, si pretium propyleni pergere cadere, pretium acrylonitrili adhuc facultatem habebit decrescendi sub pressione nimiae copiae.

Ab anno 2022 ad annum 2023, Sina 1.38 miliones tonnarum per annum officinarum acrylonitrili augebit, quarum multae sunt machinae refinatoriae et chemicae integratae, quae probabilius in operationem inducentur. Attamen, infra productum, sola ABS celeriter evolvitur, sicut acrylica et acrylamida in statu tepido sunt, quod necessario condicionem superfluae copiae creabit. Expectatur ut in proximis tribus annis, cum amplificatione capacitatis acrylonitrili, lucra industriae decrescant, et nonnullae novae installationes periculum morae et dilationis patiantur.

Chemwin is a chemical raw material trading company in China, located in Shanghai Pudong New Area, with port, wharf, airport and railway transportation network, and in Shanghai, Guangzhou, Jiangyin, Dalian and Ningbo Zhoushan in China, with chemical and dangerous chemical warehouses, with a year-round storage capacity of more than 50,000 tons of chemical raw materials, with sufficient supply of goods.chemwin E-mail: service@skychemwin.com whatsapp:19117288062 Phone:+86 4008620777 +86 19117288062

Tempus publicationis: Iun-XXIX-MMXXII